The Key to Customer Success? Metrics.

If your business operates under a renewable revenue model, then you know that fighting churn for customer retention is key. You probably have a Customer Success team helping your clients achieve the highest return on their investment in your business – but how should they measure your clients’ success? Furthermore, how should they predict churn to mitigate client issues?

Strategic metrics can help your Customer Success team determine client account health and measure their success by tracking key indicators of engagement, satisfaction, and risk factors. From this information, you can also create meaningful customer experiences that propel clients towards their business objectives. Likewise, tracking trailing indicators of retention can help determine what contributes to churn. Here are five key metrics you should start tracking today!

Net Promoter Score

Net Promoter Score (NPS) is a feedback metric that comes from a single-question survey. These surveys ask clients if they would recommend your product, service, or business, using a scale of 0 to 10 to indicate how happy they are with their experiences.

Promoters give a score of 9 or 10.

Passives give a score of 7 or 8.

Detractors give a score of 6 or less.

NPS is calculated by subtracting the percentage of detractors from the percentage of promoters.

While NPS is a good indicator of loyalty, it’s also an opportunity to improve customer experience. Engage with promoters to learn what your business is doing right and engage with passives to learn what you can improve upon.

Net Renewal Rate & Gross Renewal Rate

Net Renewal Rate (NRR) is a percentage that measures the total revenue gained from renewals and expansions (i.e., upsells, cross-sells), offset by revenue lost from churn.

Gross Renewal Rate (GRR) is a percentage that only measures revenue gained from renewals, offset by revenue lost from churn – it’s not affected by revenue gain from expansion (which may very well cancel out some lost revenue from churn).

For these reasons, GRR can never exceed 100%. On the other hand, NRR can exceed 100% and in some cases it may be a more accurate reflection of your business’s progress.

Churn

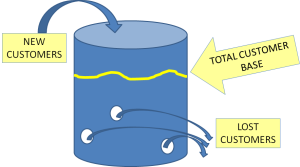

There are several ways to measure churn. But first – it’s important to understand how churn affects the growth of your business.

Your business’s growth depends on the continued satisfaction and success of your existing clients, as the cost of acquiring new clients vastly outweighs the cost of retaining existing clients.

Many use the ‘leaky bucket analogy’ to illustrate this. It takes more time, effort, and resources to fill the bucket (or, your client base) with water (or, new clients), if there are leaks in the bottom of the bucket – which represent your clients lost to churn. It may be easier to simply plug the holes (or, retain your existing customers). If you want to plug these leaks, you first need a reliable metric you can use to understand the churn your business may be experiencing.

Customer Churn Rate (CCR) is the percentage of clients you lost in a period.

A low or even negative CCR is a good thing – that means you may have gained revenue in a period! But to that point, CCR doesn’t actually measure revenue, and therefore is doesn’t measure the full impact of churn on your business.

You can calculate Gross Revenue Churn (GRC) and Net Revenue Churn (NRC) percentages to get a better idea of how churn is affecting you. Similarly to renewal rate metrics, NRC considers gained revenue from expansion which may offset lost revenue and GRC only considers lost revenue.

Customer Lifetime Value

Customer Lifetime Value (CLV) is the total value of a typical client throughout the course of their relationship with your business. CLV touches all aspects of business from product design to marketing and sales.

The flipside of the CLV coin is Customer Acquisition Costs (CAC). CAC is how much a typical client costs to your business. The ratio of CLV to CAC pins the profit against the expense of acquiring new clients. Your Customer Success team plays a crucial role in driving up CLV by improving retention rates, reducing churn, and expanding revenue.

Account Health

Everyone agrees that account health is important, but how exactly do you measure it? For most businesses, account health is scored on several factors including product usage, risk factors present, payment history, and number of support tickets. But these factors can change depending on shifting managerial priorities or changing customer success processes.

No matter how account health is scored, it should inform your future engagement with clients. You can improve retention and provide great customer success experiences by creating and following a playbook for rectifying scenarios in which account health might suffer.

The Bottom Line

Churn may be Public Enemy #1 in the world of renewable revenue, but there’s nothing to fear. Metrics can arm your leadership team with the tools needed to tap into the mutually beneficial goldmine that is customer success. After all, when your clients succeed, your business does too.

So what are you waiting for? Contact us today and let’s talk about how to use metrics to improve your business processes.

Stay in the Loop

Subscribe to get all our latest content sent directly to your inbox!