Sage Sales Tax (Avalara)

Simplify tax compliance with automation

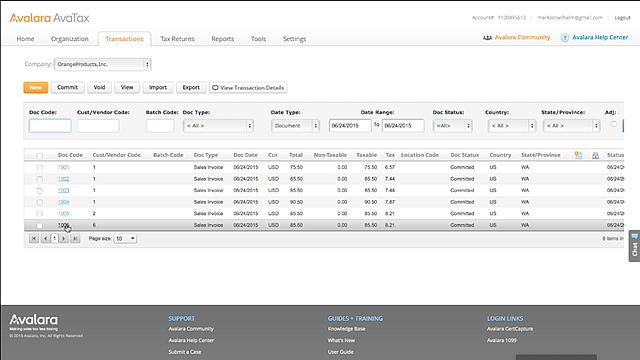

Like what you see? Get a closer look.

Like what you see? Get a closer look.

Which steps will Sage Sales Tax automate?

Reviews & Ratings

A Crowd Favorite

“Avalara keeps up with all the nationwide changes in taxing jurisdictions month-to-month so we can focus on our business transactions and not struggle with tax compliance. They operate seamlessly in the background and keep us accurate and exposure-free.”

Theresa F., Controller

“My favorite thing about Avalara would have to be CertCapture! It has allowed me to be able to organize and keep better track of all exemptions that have been received. In addition, you can use this service to request documentation, which save us a lot of time from going from client to client asking for new documentation. You just request, they send in information, and presto! You have all updated exemptions in one place! It's magic!”

Jasmine G., Staff Accountant

Sage Sales Tax (Avalara) Stats

Headquarters:

Seattle, WA

Founded In:

2004

Mobile App:

No

Free Trial:

Yes

User Minimum:

None

Subscription Types:

Pricing dependent on number of invoices processed on a yearly basis

Deployment Options:

Cloud-based, installed

Ideal For:

Small businesses to enterprises

Popular Industries Served:

Retail, Software, Manufacturing, Fuel and energy, Hospitality, Supply chain, Beverage Alcohol

Favorite Features:

700+ Integrations; Ease of use; Quality of support

How much does Sage Sales Tax (Avalara) cost?

Avalara’s price is dependent on the number of invoices or documents your company needs processed on a yearly basis. The pricing is split into tiers, depending on your company’s needs. We would be happy to speak with you and consult you on your company’s needs and offer you a quote.