CFO Series: How to Unlock Revenue Insights with Better Coding

As the CAO for a $30 billion landlord, I once provided an educated guess that we had about $8 million of rent relief (credits) given to certain tenants. My boss summarily yelled me out of the room. When we came back with the report and data that showed the location, tenant, and the total amount detailing how we were “nickel and dimed” across the portfolio, my management peers changed the processes for giving credits immediately. While this was commercial real estate, this example of effective revenue coding could apply to any organization.

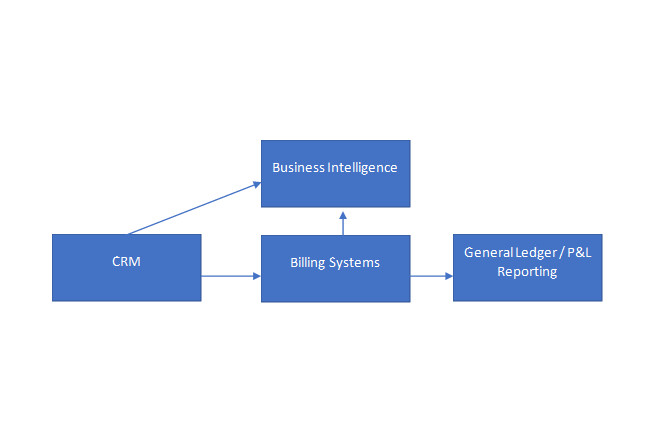

The challenge of revenue coding to obtain useful insights involves asking a series of questions about the business, the desires of management, then determining whether the insights required are best obtained via a combination of business intelligence (“BI”) and the general ledger/income statement reporting. Also, the business can lose trust in the insights when critical reports between systems & the general ledger do not agree.

The Revenue Coding Process

While there are some commonalities across businesses, not every business is the same nor organized the same; thus, the insights necessary should be tailored to the company. As such, the revenue coding process for developing these insights involves a series of questions:

- Accountability: One critical aspect is developing revenue accountability within the organization. Who is responsible? Will you organize revenue by product lines? By Customers? By Location? By Region? And so on. One should also consider how these might change as the sales organization grows and possibly restructures over time.

- Match with Expenses: Often, there is a need to capture expenses in concert with revenue. Is this product line profitable enough? Is the advertising or sales organization relative to the revenue essential? Is the work project-based? Looking back at the earlier real estate example, the company had no insights into the four or five different recovery income & expense categories. By creating that visibility, they were able to improve recovery ratios significantly in the portfolio.

- Budgeting & Forecasting Needs: Budgeting is, in essence, a point in time forecast. Updating that forecast can be critically important as the business changes. Therefore, how will the organization want to forecast its revenue? In what level of detail? How will it want to report on this information?

- Data & Business Organization: Where does the data currently reside? Is it captured in the systems & modules where it should be? Who enters the data, and should you consider another colleague or department? Organizations should carefully evaluate if they are using CRM as their billing system and whether that is the appropriate place for that financial data to reside.

The Solutions

The solutions to data problems are not solved merely by technology alone. The organizational structure, the right people, and processes are also critically important. Once effective technology with good data governance is layered in, this unlocks significant organizational potential.

- Communicate & Train Coding Necessary – The portion of the organization responsible for coding the data must be trained on the coding essential to support the required reporting. This commitment to getting this information right at the point of original entry is critical to success.

- Business Intelligence – A well-designed business intelligence environment through a Microsoft Power BI, Tableau, or other solution will provide the most robust data pivots and analysis. What is critically important is that the totals of the reports used in the organization agree and reconcile to financial statement line items in the ERP. Without these controls, the organization will quickly grow frustrated.The significant advantage BI environments have over the general ledger/ERP system is that they are much more flexible. Once ERP data is recorded, it is locked in that manner historically for comparison purposes.

- General Ledger / ERP – The general ledger and ERP package can include a multitude of options for pivoting data. For example, if a company has business units (10), locations (5), general ledger accounts (10) – these all work in concert to allow for 500 different pivots of information alone! The inherent functionality of Sage Intacct makes for a powerful platform that leverages locations, companies, business units, and GL accounts to obtain insights.

- Data Governance – If your organization is larger and increasing in complexity, then establishing a consistent and reliable data governance procedures going forward is critical to ongoing success. Allowing every department to change the organizational data architecture is a recipe for disaster.

- Culture – Lastly, the organization must commit to ensuring the data is correct. While the organization certainly should have data champions, no one person or department alone can be solely responsible. The entire organization must commit to the importance of useful data and insights and communicate issues when they see them help get the root causes corrected.

If your organization has never walked through these discussions, it can be daunting. BrainSell employs a deep team with a wealth of knowledge and resources to help your organization determine the solution(s) that is (are) right for your team. There is no “one” solution for all companies as what is right for one organization may not be right for you. Let us help you through these discussions; give us a call today!

This is the second installment in our CFO Series. Check out all the posts in the series here.

Author Bio

Jim Thurston

Jim Thurston is the VP of Financial Process Management at BrainSell. He has 20 years of finance and accounting experience (CPA) and 14 years of real estate experience with two of the best-in-class, industry-leading S&P 500 companies in the United States.

View Posts

Related Post

Stay in the Loop

Subscribe to get all our latest content sent directly to your inbox!